- Transformational acquisition will make GMM Pfaudler the market leader in corrosion-resistance technologies, systems and services

- Revenue of the combined entity estimated to be around Rs. 20 bn (USD 266 mn*)

- Patel family (promoters of GMM Pfaudler) to invest alongside GMM Pfaudler

- This acquisition is expected to be earnings accretive immediately to the shareholders of GMM Pfaudler

GMM Pfaudler Limited (“GMM” or “Company”) today announced the signing of definitive agreements to acquire a majority stake in the global business of its parent, the Pfaudler Group (“Pfaudler”) from the private equity firm Deutsche Beteiligungs AG Fund VI (“DBAG”). As per the agreements, GMM (directly and through its subsidiary Mavag AG) and the Patel family will acquire, a 54% and 26% equity stake respectively in the Pfaudler Group. DBAG will continue to retain the balance 20% stake. The consideration for the 54% stake acquired by GMM, which is expected to be around USD 27.4 million, will be funded by the Company through a mix of internal accruals and debt.

Pursuant to the acquisition, GMM shall become the ultimate holding company with the entire business of Pfaudler being consolidated into the Company. The Company will have a consolidated revenue of Rs. 20bn. and EBITDA of approximately Rs. 2.5 bn.

GMM will become the world leader in corrosion-resistance technologies, systems and services with 12 manufacturing facilities across 8 countries and 4 continents and employing around 1,500 people.

(*Assuming an exchange rate of USD: INR 75)

Management Commentary

Commenting on the transaction:

Mr. Tarak Patel, Managing Director, GMM said, “Over the last 5 years, we have shown an unparalleled track record of growth at GMM and it is now time to take our Company to the next level through this transformational acquisition. Being an integral part of Pfaudler for more than 3 decades, not only do we understand the business very well, but have also managed to build a collaborative relationship with the different Pfaudler units around the world. This transaction is unique from the stand point that it combines the strengths of three very different partners - Promoter family, Professional Management and Private Equity, which we believe will help extract synergies and create value for all stakeholders. On a personal level and as the third generation of a family business that began in 1963, it is a moment of great pride to see GMM enter the global stage.”

Thomas Kehl, CEO, Pfaudler said, “Over the last few years Pfaudler has spent significant capex in modernizing its manufacturing facilities across the globe. This transaction will bring synergies across multiple levels, the combined business will now be in a position to leverage GMM’s highly successful lean production model and low-cost methods to improve both revenue and profitability. In addition, our order book remains strong on the back of robust demand driven by the Chemical and Pharmaceutical industries. Together with the GMM management and DBAG, who we have worked closely with over the last 5 years, we expect to complete a seamless integration and hit the ground running.”

Tom Alzin, Managing Director, DBAG said, “The rationale behind our investment in Pfaudler in 2014 was to back a high-quality supplier of corrosion-resistant equipment in a global niche market. The Group’s progress over the past 5 years along with the phenomenal performance from GMM validates our investment decision. As a former Board Member of GMM, I can say that we have built a strong relationship with the Patel family and remain committed to support the business through expansion of the product portfolio by add-on acquisitions. Given the synergies of the combined business and the long association between Pfaudler and GMM, we believe that the combined business will be EPS accretive from the start and we will continue to remain invested in the Company.”

Subject to the satisfaction of certain closing conditions and regulatory approvals, the transaction is expected to close in November 2020.

Alvarez & Marsal and Trilegal acted as the exclusive financial and legal advisors, respectively to GMM Pfaudler.

The company will conduct a call at 4:00 PM IST on August 24, 2020 where the senior management will discuss this transaction and answer questions from participants. To participate in this conference call, please dial the numbers provided below ten minutes ahead of the scheduled start time. The dial-in number for this call is +91 22 6280 1107 / +91 22 7115 8008.

About GMM Pfaudler

GMM is a leading supplier of process equipment to the pharmaceutical and chemical industries. GMM is the market leader and has more than five decades’ experience in manufacturing Glass- Lined Equipment. Over the years, GMM has diversified its product portfolio to include Mixing Systems, Filtration & Drying Equipment, Engineered Systems and Heavy Engineering Equipment and is today a one-stop shop for the chemical process industry. The Company has a long- standing track record of consistent dividends.

For further details please contact www.gmmpfaudler.com

About Pfaudler

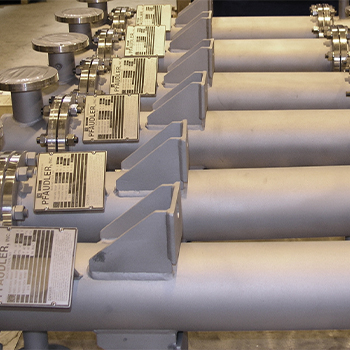

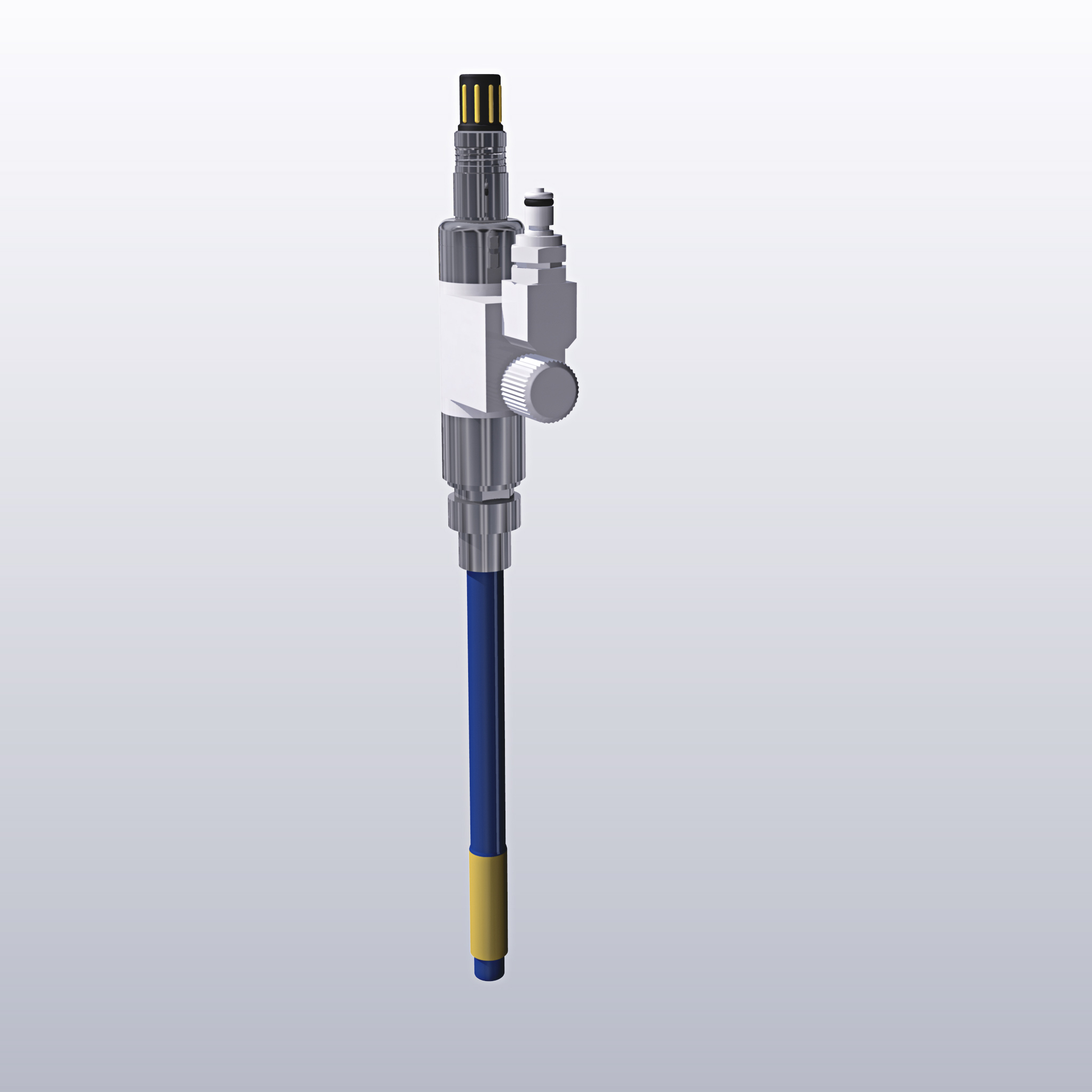

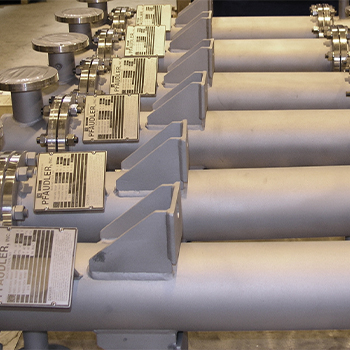

Since 1884, Pfaudler has grown to be a truly global, multi-national and diverse company, employing over 1,500 employees and manufacturing facilities on four continents. Pfaudler is present on the market with several branded product lines covering a broad portfolio that includes fluoropolymers, filtration & drying, engineered column systems, lab & process glass, sealing technology and glass-lined & alloy systems. Pfaudler’s Systems and Services capabilities allow us to support the customers from the lab to the full-scale production plant, including optimizing and improving the whole life cycle of any process equipment normally used in the chemical, pharmaceutical and food industries. Pfaudler is more, Much More than Glass-Lined.

For more information please visit: www.pfaudler.com

About DBAG

Deutsche Beteiligungs AG, a listed private equity company, initiates closed-end private equity funds, and itself invests alongside those funds predominantly in well-positioned mid-market companies with development potential. DBAG focuses on those industry sectors where Germany’s ‘Mittelstand’ is strong in international comparison. A growing portion of DBAG's equity investments is are deployed in its new focus sectors of broadband/telecommunications, IT services/software and healthcare. Its long-term, value-enhancing, entrepreneurial investment approach makes DBAG a sought-after investment partner in the German-speaking world. DBAG Group’s assets under management or advisory amount to 2.5 billion euros.

For more information please visit: www.dbag.de

Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products Products

Products 4- Others , Applications

4- Others , Applications 4- Others , Applications , Steel Industry

4- Others , Applications , Steel Industry 3- Pharmaceuticals , Applications

3- Pharmaceuticals , Applications 3- Pharmaceuticals , Applications

3- Pharmaceuticals , Applications 2- Chemicals Industry , Applications

2- Chemicals Industry , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , Applications

2- Chemicals Industry , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , 3- Pharmaceuticals , Applications

2- Chemicals Industry , 3- Pharmaceuticals , Applications 2- Chemicals Industry , Applications

2- Chemicals Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 1- Food Industry , Applications

1- Food Industry , Applications 4- Others , Applications , Wood Industry

4- Others , Applications , Wood Industry 4- Others , Applications , Tobacco Industry

4- Others , Applications , Tobacco Industry